reit tax benefits uk

Corporation Tax is payable on its profits and gains from. For one thing because.

Reit Dividends And Uk Tax Assura

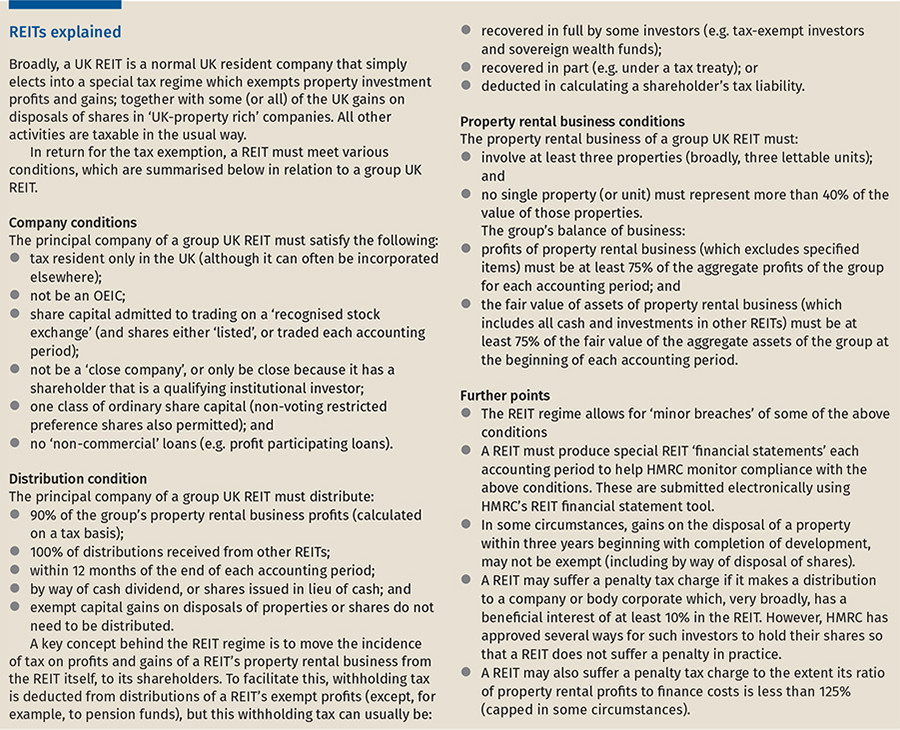

An advantage of the regime is that qualified property rental businesses subject to the REIT tax benefit are not subject to UK corporation.

. A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received. The UK REIT regime uses a ratio test that compares profits of a UK REITs tax-exempt business with its financing costs. Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs.

How Is Reit Income Taxed Uk. REITs benefit from some pretty special tax advantages. Depreciation and Return of Capital.

UK REIT property income distributions are taxed as property income. Real estate trusts are a different animal from typical corporations. A real estate investment trust REIT is a property investment company which very broadly simulates from a tax perspective direct investment in UK property and so avoids the.

After tax return from UK company After tax return from UK REIT Enhancement of return UK pension fundsISAs SIPPs and Sovereign wealth funds 75 100 333 Overseas investor. So it makes sense that their accounting practices. A REIT or Real Estate Investment Trust is a specialist tax efficient investment vehicle built around real property assets and more specifically property rental activities.

Both the profits and financing costs are calculated in. REIT Tax Benefits No. REITs in IRAs.

The UK REIT regime is an improvement to the tax environment for UK real estate companies. Corporation taxpayers will be subject to tax. Benefits for companies Tax.

Where the REIT pays a dividend to a holder of excessive rights a penalty tax charge can arise on the REIT. Dividends from REITs have basic rate income tax withheld at source by the REIT and are taxable on the shareholder as if they were profits of a UK property business. Advantage 3 - Tax Efficiencies.

UK-resident individuals will be subject to income tax on PIDs at the normal rate of income tax with a current maximum rate of 45. As at October 2018 there are c75 UK REITs. This includes publically traded REITs generally listed or traded on the London Stock Exchange as well as institutionally owned REITs.

A REIT is an internationally-recognised investment vehicle promoted by governments to encourage the wider public and institutional investors to pool their investment in real estate. The benefits for companies and the benefits for individual investors. Therefore UK REITs usually have restrictions in their articles of.

A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business. A normal UK company is required to pay Corporation Tax on profits at a rate of 19. A double tax benefit In fact the tax treatment of REITs by the IRS makes them ideal candidates for IRAs and other retirement accounts.

When market conditions improve the regime is expected to have a positive long-term impact. The benefits of REITs can be broken down into two separate categories.

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

Why Reits Are Awesome Investment How To Invest In Real State Finance Investing Investing Money Management Advice

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Reits Real Estate Investment Trusts And Tax Tax Worldwide

You Can Learn New Ways To Increase The Profitability Your Property Investments By Checking Out Our Real Estate Investment Trust Real Estate Investing Investing

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Taxation Of Reits Ringing In The Changes

How Income Tax Rules Help Reit Investors Earn More In Long Term